Cryptocurrency Flash Crashes and Cryptocurrency Loans

In June 2019, Bitcoin core (BTC) plummeted by almost 18% within minutes. An incidents like this are called flash crashes. There are a lot of different things that can crash a market in a flash. Trading programs make crashes way worse. Most trading programs’ main algorithms can recognize aberrations and can set off a security mechanism that sells your holdings to avoid any further loss.

Flash crashes are especially damaging to traders who use margin or leverage , but it is also harmful to responsible users with simple stop losses as well. As what happens in a flash crash is a negative feedback loop .

For example someone market sells 1000 BTC, this amount at any exchange has very high slippage and the order will dig very deeply into the order book bringing the market price way down. Then as the market price is going down it triggers many stop-losses and margin calls which in turn pile onto the market order snowballing the issue.

The Risk of lending with Flash Crashes

As margin loans are the most popular form of Bitcoin loans, they are especially susceptible to and a root-cause behind flash crashes. A margin loan is essentially a collateralized loan within an exchange where you can borrow funds against your balance in order to increase your exposure or short a trade .

However, exchanges don’t take on the risk of you not repaying your loan, instead they create a collateral requirement (such as 120%) and if your balance falls below that 120% threshold your funds are market sold and your loan automatically paid back.

Even if you are a responsible borrower and keep your margin level way above the requirement (180% collateral when requirement is 120%) you can still get liquidated and unfairly punished in a flash crash. As the price move can be so dramatic that for a couple seconds you are underfunded and liquidated even if price bounces right back up as it usually does.

How to avoid Flash Crashes

The best way to avoid a flash crash is to borrow Bitcoin in a way that doesn’t get liquidated when the price drops. There are multiple types of Bitcoin loans and places to do this.

Our recommendation if you want competitive rates and are using collateral is a P2P loan from Btcpop.co . Their open market platform, and ability to use altcoins as collateral , and ability to set your own terms and rates makes it a good choice for margin lending .

If you add enough good collateral your loan will likely get funded with some very competitive terms. And in this case, while you still hold risk for your collateral value flash crashing, as long as you make the payments on time, it doesn’t matter as you are not going to be liquidated by a system.

History of Flash Crashes

Don’t think a flash crash is going to happen today with improved market liquidity? You would likely be wrong as there is a long history of flash crashes where at the time nobody thought it was going to happen either.

June 26, 2019 Coinbase – Bitcoin core (BTC)

|

Exchange |

Coin / Asset |

Price Drop |

Duration |

|---|---|---|---|

|

$13,750 to $11,800 |

1 hour |

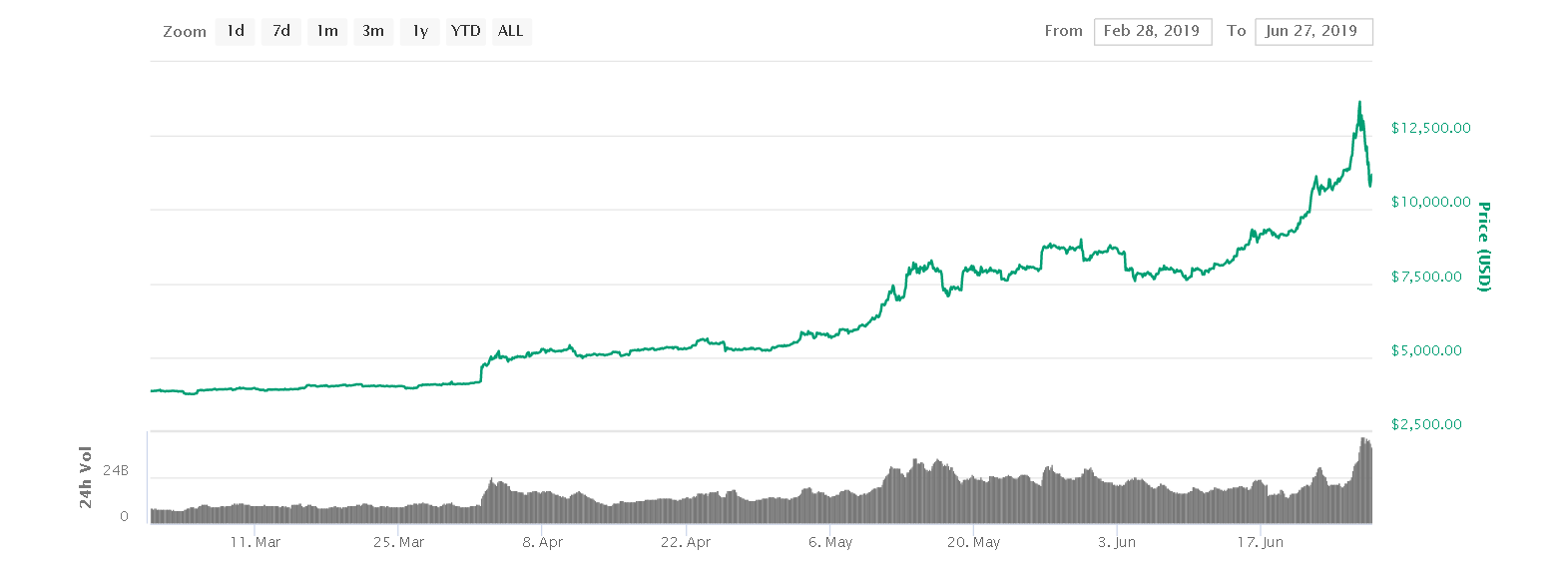

Coinbase customers weren’t able to access their accounts on the website due to an outage. During this time the price of Bitcoin core (BTC) dropped 18% about $1,700.

May 26, 2019 | Poloniex – Clams (CLAM)

|

Exchange |

Coin / Asset |

Price Drop |

Duration |

|---|---|---|---|

|

77% |

Less than 1 hour |

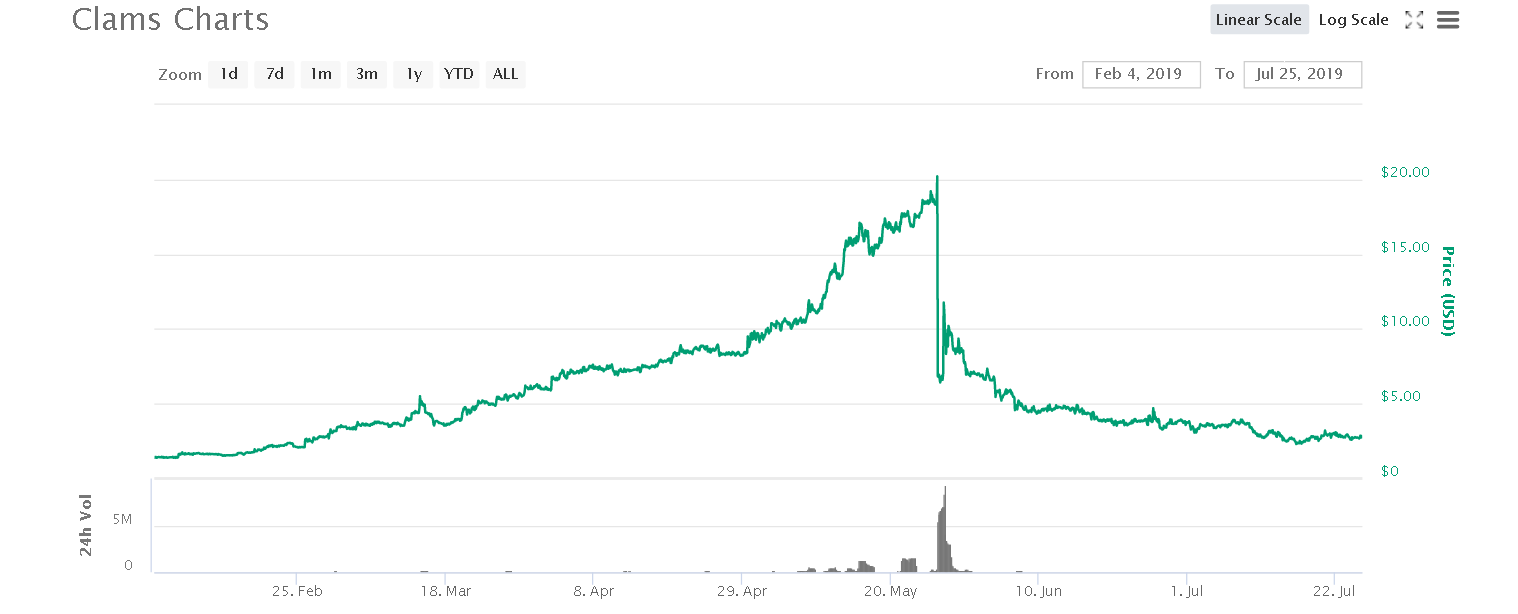

The margin lending pool in Poloniex lost $13.5 million due to automatic liquidations. This is one of the rare examples of margin lending risk showing its ugly face.

May 29, 2019 | Kraken – BTC/CAD

|

Exchange |

Coin / Asset |

Price Drop |

Duration |

|---|---|---|---|

|

BTC / CAD – Canadian Dollar |

$11,200 to $101 |

1 minute |

May 7, 2017 | Kraken – Ethereum (ETH)

|

Exchange |

Coin / Asset |

Price Drop |

Duration |

|---|---|---|---|

|

$98 to $26 |

Kraken revealed in Reddit that it was due to a cascade of margin liquidations that couldn’t be stopped even if they had a DDoS attack or not. Kraken also said that if they had stopped trading while under attack it would have been way worse for traders.

June 21, 2017 | GDAX – Ethereum (ETH)

|

Exchange |

Coin / Asset |

Price Drop |

Duration |

|---|---|---|---|

|

Ethereum (ETH) |

$319.00 to $0.10 |

seconds |

The flash crash Ethereum (ETH) dropped more than 800% due to a multimillion-dollar market sell order and triggered stop loss orders and margin trade liquidations in GDAX(now Coinbase Pro . Coinbase Pro reimbursed traders. All executed orders honored, no trades reversed and margin calls or stop-loss orders executed were credited.

November 29, 2017 | Bitfinex – NEO, OMG, and ETP

|

Exchange |

Coin / Asset |

Price Drop |

Duration |

|---|---|---|---|

|

$33 to $4 |

minutes |

||

|

Bitfinex |

$3.50 to $0.05 |

minutes |

Multiple flash crashes in Bitfinex caused a total price drop of more than 90% on NEO , OMG, and ETP. BTC ’s price corrected by 20% triggering stop-losses and liquidations.

August 19, 2015 | Bitfinex – Bitcoin (BTC)

|

Exchange |

Coin / Asset |

Price Drop |

Duration |

|---|---|---|---|

|

Bitfinex |

Bitcoin (BTC) |

$255 to $179.35 |

30 minutes |

” BTC plummeted from $255 to $179.35 on the exchange on August 19, 2015. This was after the incident on summer of 2015 where BTC dropped 29% in Bitfinex and 14% on the entire global average. The flash crash was triggered by several leveraged positions. The exchange dealt with “technical difficulties” and “lag in its live engine.

February 10, 2014 | Btc.e Exchange – Bitcoin (BTC)Cryptocurrency Flash Crashes | June 21, 2017 | GDAX – Ethereum (ETH)

|

Exchange |

Coin / Asset/s |

Price Drop |

Duration |

|

Bitcoin (BTC) |

$620 to $102 |

seconds |

The Bitcoin Wiki page said “The crash is the result of what appears to be a single person selling at least 6,000 bitcoins significantly below the market price,”

April 10, 2013 | Mt. Gox – Bitcoin (BTC)

|

Exchange |

Coin / Asset |

Price Drop |

Duration |

|---|---|---|---|

|

Bitcoin (BTC) |

$266 to $100 |

Few hours |

The flash crash was due to “high volume trades”. Mt. Gox customers were complaining of login issues and extreme lag using the trading engine that day.

June 19, 2011 | Mt. Gox – Bitcoin (BTC)

|

Exchange |

Coin / Asset |

Price Drop |

Duration |

|---|---|---|---|

|

Mt. Gox |

Bitcoin (BTC) |

$17 to $0.01 |

The sell-off was initiated by the announcement that Mt. Gox had been hacked. The Mt. Gox website was also inoperable at the time and customers could not access their funds.

Trade Safely: Flash Crashes Can Happen at Any Time

So take this article as a reminder that flash crashes are a real risk and can damage even the most responsible trader. It might just be worth your time to borrow on a different platform or explore alternatives if you really want to use leverage without this catastrophic risk hanging over your head.